Source: bing.com

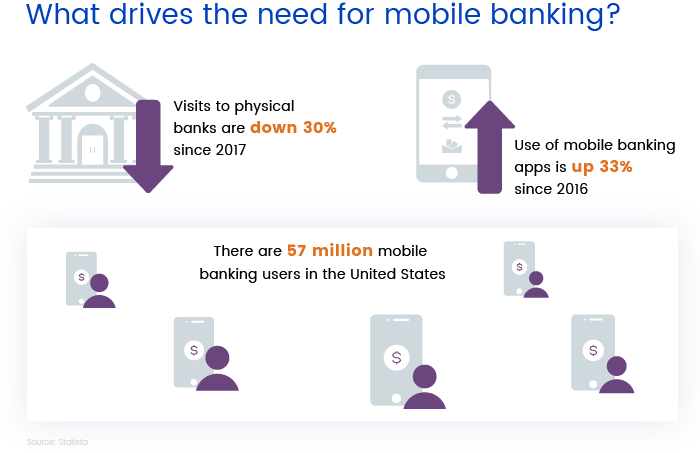

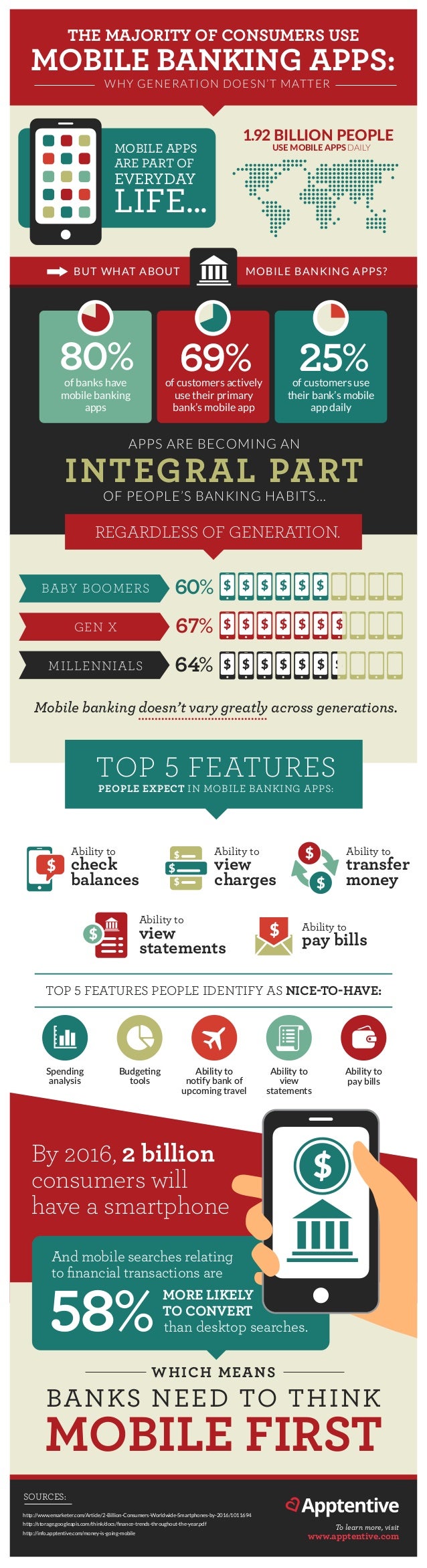

Source: bing.comWith the advent of technology, everything has become more accessible and convenient for people. One such convenience that has become popular is mobile banking. Mobile banking apps have revolutionized the way people manage their finances. From checking account balances to transferring money, mobile banking apps have made it possible to perform financial tasks from anywhere, at any time. In this article, we will discuss the benefits of using mobile banking apps for your financial needs.

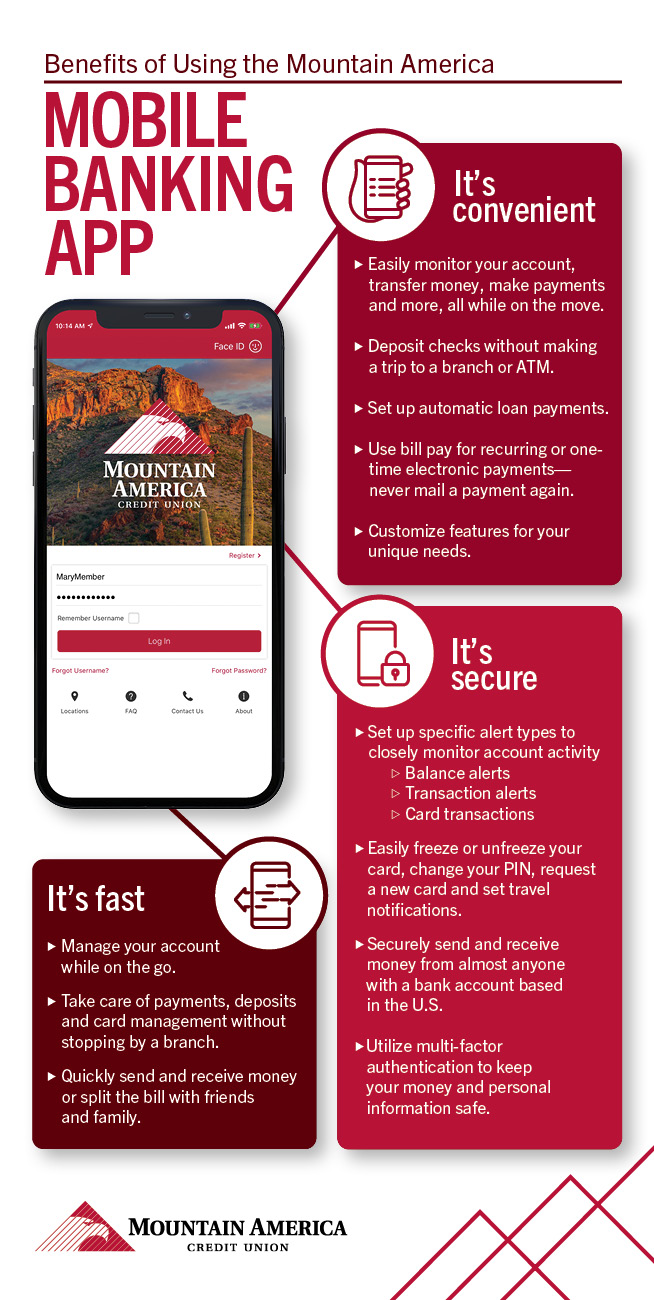

Convenient and Accessible

Source: bing.com

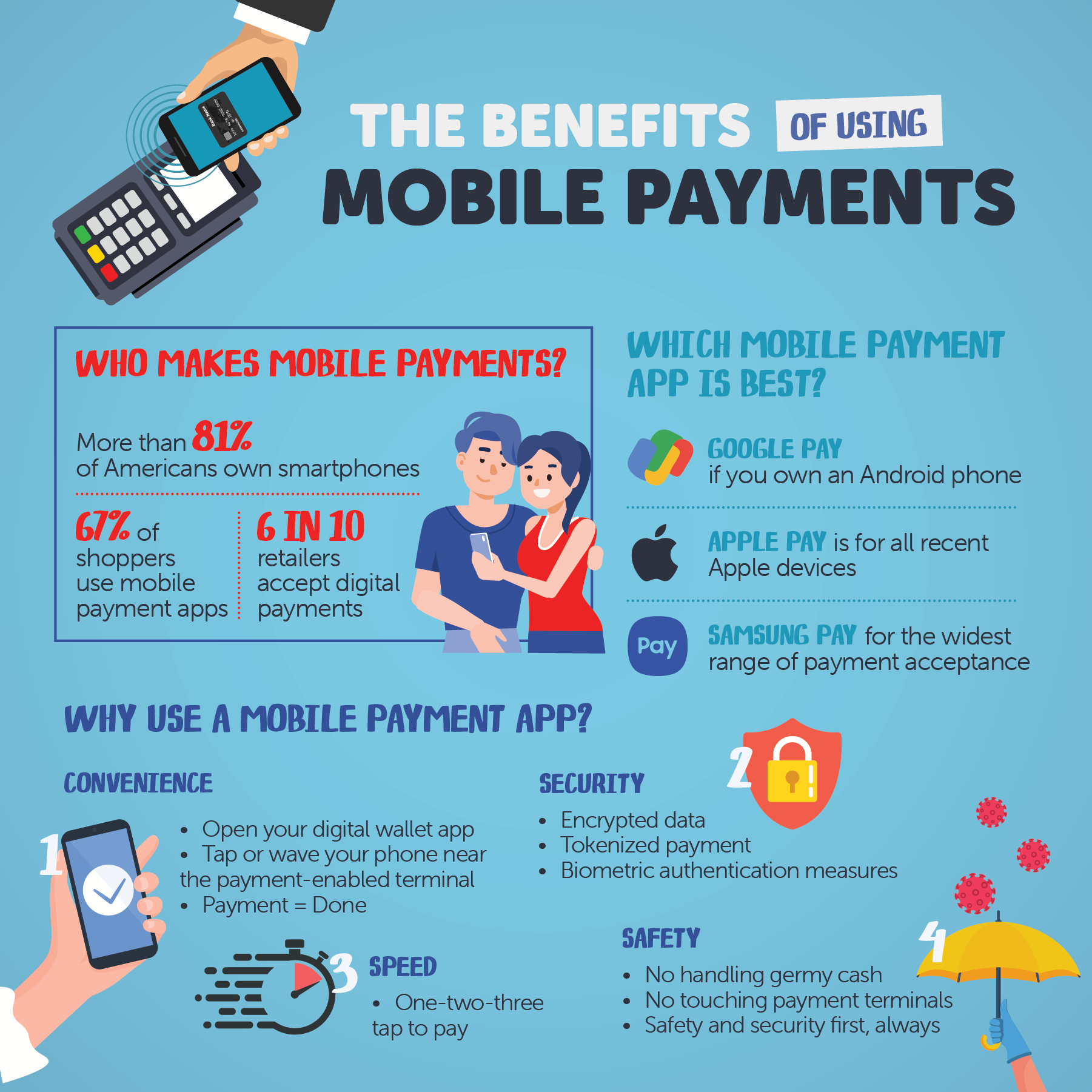

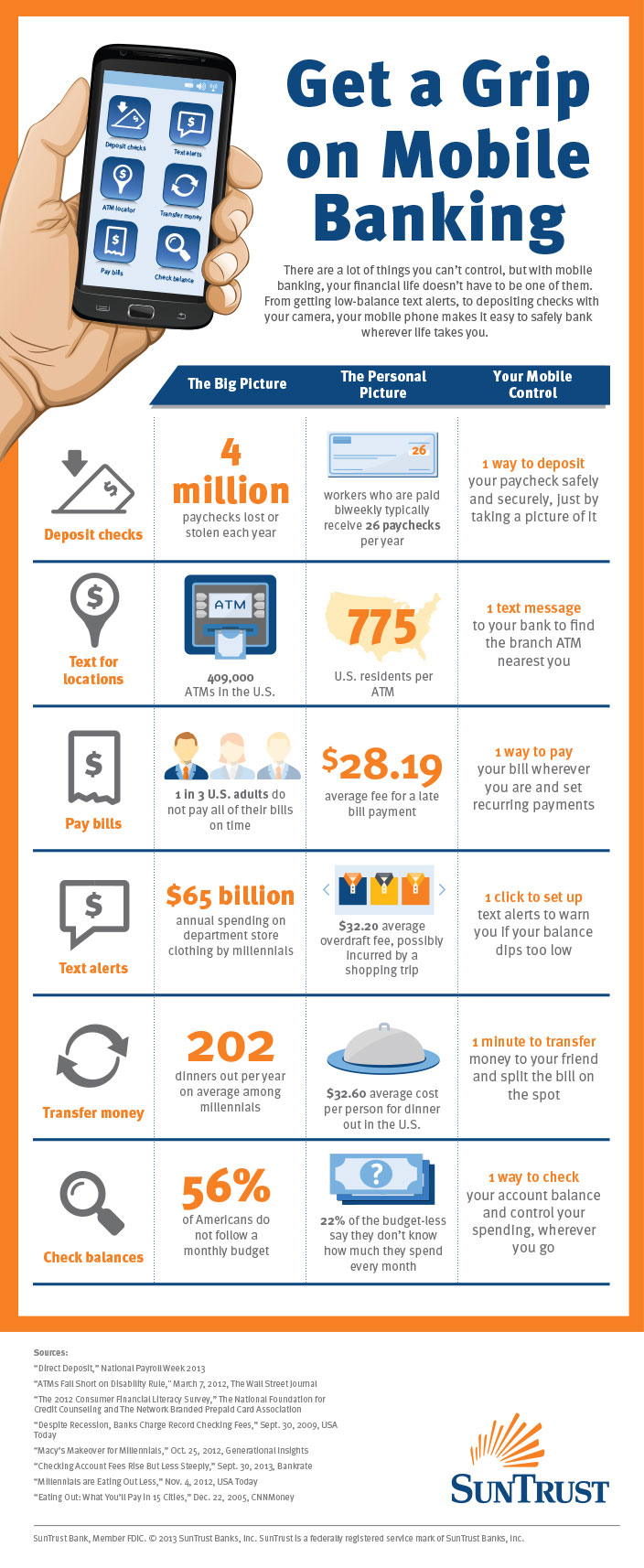

Source: bing.comOne of the biggest benefits of using mobile banking apps is the convenience they offer. With mobile banking apps, you no longer have to visit a bank branch or stand in long queues to perform financial transactions. You can easily manage your finances from anywhere, at any time, using your smartphone or tablet. This means you can perform tasks like checking account balances, paying bills, transferring money, and more, while on-the-go.

Easy to Use

Source: bing.com

Source: bing.comAnother benefit of using mobile banking apps is that they are easy to use. Most mobile banking apps are designed with user-friendliness in mind. This means that even if you are not tech-savvy, you can still use the app with ease. The app's interface is simple and intuitive, making it easy for you to navigate and find the features you need.

Real-time Transactions

.jpg) Source: bing.com

Source: bing.comMobile banking apps allow you to perform transactions in real-time. This means that you can see the changes in your account balance immediately after performing a transaction. You no longer have to wait for days to see if your transaction has been processed. This feature is particularly useful when you need to transfer money urgently or pay a bill that is due soon.

Increased Security

Source: bing.com

Source: bing.comMobile banking apps have advanced security features that make them safe to use. These features include biometric authentication, such as fingerprint or facial recognition, two-factor authentication, and encryption. These security measures ensure that your financial information is protected and that your transactions are secure.

24/7 Customer Support

Most mobile banking apps offer 24/7 customer support. This means that if you have any issues or queries, you can contact customer support at any time of the day or night. You can usually contact customer support through the app itself, or through the bank's website or phone number.

Cost-effective

Source: bing.com

Source: bing.comMobile banking apps are cost-effective. Most banks offer their mobile banking apps for free, and you don't have to pay any additional fees to use them. This means that you can perform financial transactions without incurring any extra costs.

View Account Balances and Transaction History

Source: bing.com

Source: bing.comMobile banking apps allow you to view your account balances and transaction history. This means that you can keep track of your finances and monitor your spending. You can also see if there are any unauthorized transactions in your account, and report them immediately.

Transfer Money Easily

Source: bing.com

Source: bing.comMobile banking apps make it easy to transfer money between accounts. You can transfer money between your own accounts, or to someone else's account. You can also set up recurring transfers, which is useful for paying bills or making regular payments.

Pay Bills

Source: bing.com

Source: bing.comMobile banking apps allow you to pay bills from your smartphone or tablet. You can pay utility bills, credit card bills, and other bills using the app. This means that you no longer have to visit a bank branch or use a computer to pay your bills.

Apply for Loans and Credit Cards

Source: bing.com

Source: bing.comMobile banking apps also allow you to apply for loans and credit cards. You can fill out the application form, upload the required documents, and submit the application from your smartphone or tablet. This is a convenient way to apply for credit without having to visit a bank branch.

Conclusion

Mobile banking apps offer numerous benefits to users. They are convenient, easy to use, and cost-effective. They also offer advanced security features, real-time transactions, and 24/7 customer support. With mobile banking apps, you can manage your finances from anywhere, at any time, using your smartphone or tablet. If you haven't already, it's time to download your bank's mobile banking app and start enjoying these benefits!